UK banks - Lloyds TSB accounts for highest share (21%) of negative customer comments online as it announces £3.3bn loss for Jan-Jun

Halifax receives highest proportion (20%) of positive customer comments online - during June 2011

London 10 August – Social media research specialist DigitalMR releases latest findings on what customers are saying about UK high street banks online.

DigitalMR analysed thousands of customer comments about high street banks for the month of June 2011. Over half (57%) of these customer views are positive, compared with 43% negative.

The three most mentioned banking brands are: Halifax and HSBC with a 16% share of all comments, followed by Lloyds TSB (15 %).

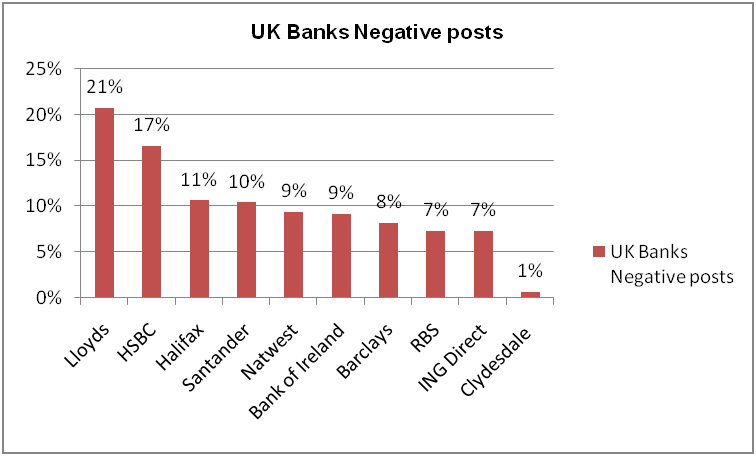

However there is a large difference between the positive and negative mentions that these banks generate. Halifax (20%) and HSBC (16%) attracted the largest proportion of positive posts, while Lloyds TSB (21%) received the most negative posts, followed by HSBC (17%).

This follows the announcements from the Lloyds Group in May that it was putting aside £3.2bn to pay customers who had been mis-sold payment protection insurance and that at the end of June it was cutting a further 15,000 jobs.

Taking the difference in positive and negative posts into consideration the clear winner for June is the Halifax with a Net Sentiment Score (NSS) of 44% followed by NatWest with 31%. Lloyds TSB was one of only two banks that achieved negative a NSS with minus 15%. Bank of Ireland achieved the lowest NSS with minus 51%.

DigitalMR’s report (powered by SociaNuggets) analyses thousands of customer comments posted via a range of relevant finance related websites and open access social media platforms. It measures, not only the number of comments posted by consumers on the internet, but also sentiment – whether these posts are positive or negative.

Results are based on comments posted by consumers on the major UK banks: Lloyds TSB, HSBC, Halifax, NatWest, Bank of Ireland, Santander, Barclays, RBS, ING Direct, and Clydesdale Bank.

Managing Director of DigitalMR, Michalis Michael commented: “these findings are very encouraging for the Halifax and NatWest brands as they are achieving an overall high net positive sentiment. However, recent events seem to have impacted on the Lloyds TSB brand and it will be interesting to see how online customer sentiment reacts to the planned job cuts announced at the end June.”

1) Net Sentiment Score (NSS)

Most of the banks measured, achieve a positive Net Sentiment Score (NSS) for June. NSS provides an overall percentage score of net positive posts. A positive score means a bank attracts more positive than negative posts, while a negative score suggests a higher proportion of negative posts.

The average NSS taken across all banks measured is 14%, which is good news for the banking industry as it is now attracting more positive sentiment across the internet than it does negative.

Net Sentiment Score ranking

1st Halifax : 44%

2nd NatWest : 31%

3rd ING Direct : 25%

4th Santander : 23%

5th Clydesdale Bank : 21%

6th Barclays : 15%

7th HSBC : 12%

8th RBS : 6%

9th Lloyds TSB : -15%

10th Bank of Ireland : -51%

2) Breakdown of positive and negative posts

3) Features and Services

DigitalMR measured thousands of customer posts across June regarding the services and features that banks offer. Services attracting a much higher proportion of negative mentions to positive ones were: Customer Care (18% negative vs 9% positive) and Bank Employees (16% negative vs just 4% positive).

While the service attracting a higher proportion of positive comments was Credit Cards with (18% positive vs 11% negative).

4) In their words –customer comments

Lloyds TSB

Halifax

Lloyds TSB

“THE WORST BANK!!! making it very dificult for my partner to cancel his platinum account even though he has been told previously he can do this by their work staff.........I've been with other banks that I am not too keen on but I prefer them over Lloyds TSB.Prepare to be completely ripped off by Lloyds TSB!!!”

Halifax

Natwest

Bank of Ireland

5) How can Banks use social media to their advantage?

Banks can use analysis of data from websites and other social media in the following ways:

- Engage in a one-to-one dialogue with their customers and respond to negative comments.

- Invite some of the customers to join online forums and chat groups to further express their views

- Positive sentiment can be leveraged in advertising

- Operations can learn about and fix specific branch performance issues

- Financial products can be adjusted, and new ones can be designed to meet customer needs

About the syndicated banking report

The monthly banking report monitors thousands of customers’ online conversations through comments posted on open-access social media platforms such as Twitter and Facebook, forums, blogs, microblogs and commercial websites, for UK banking services.

The report is available on annual subscription with updates provided on a quarterly, monthly or weekly basis. Results will be updated to the press on a monthly basis.

Contact

For regular reports and more information:

Michalis A. Michael

mmichael@digital-mr.com

tel: +44 751 571 0370

www.digital-mr.com

About DigitalMR

DigitalMR understands what people think and feel when they share views online. It is a specialist agency which provides a holistic approach to web based market research. It specialises in utilising social media research, especially active web-listening, and online communities to enhance its business consulting approach. The agency has pioneered new methods in online focus groups alongside tools such as video diaries, bulletin boards and online ethnography. DigitalMR is headed by founder and MD, Michalis Michael and has offices in London UK, Nicosia Cyprus, and Columbus Ohio, in the US.

About SocialNuggets

SocialNuggets technology delivers real-time market intelligence for fast moving industries by analyzing data from various social media sources with a mission to liberate social media data and sentiment analysis for use in real-time research of brands, products and features. SocialNuggets delivers ready to use market intelligence for various industry verticals including consumer electronics and banking. SocialNuggets data is delivered in bite size, ready-to-consume, infographics and is also available in the form of a full access to our data warehouse for analysis and integration with customers’ data. SocialNuggets, a Serendio company, was founded in 2011 with headquarters in Santa Clara, CA.

Share this article: