Deutsche Bank ranks first in social media buzz – that’s a good thing, right?

Nope, not in this case!

Statements such as ‘XYZ ranks first on social media buzz’ can be quite misleading. In Social Intelligence, looking at the number of posts (i.e. buzz) about a brand or company is equally important as understanding the sentiment and topics expressed in these posts.

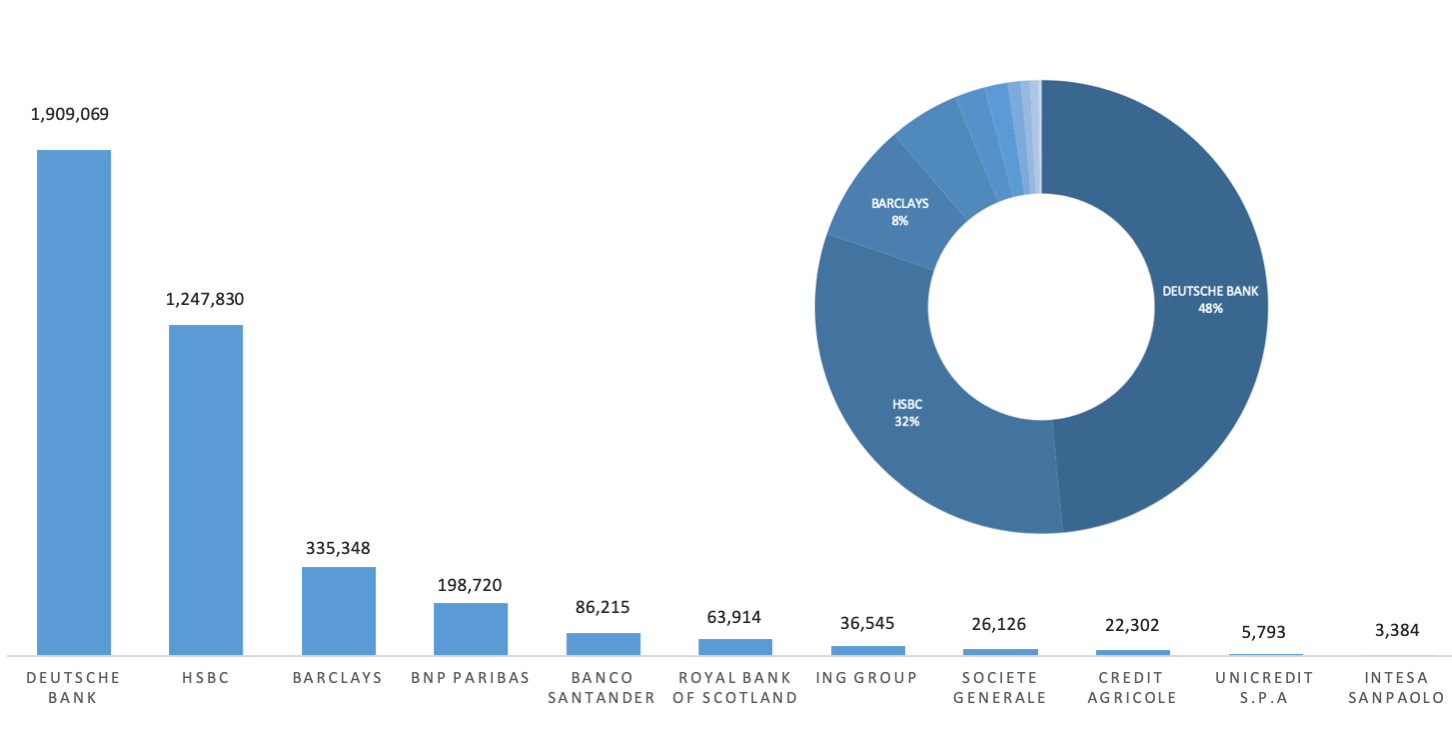

In the case of Deutsche Bank, they do indeed rank first among 10 other global banks included as part of the first listening247 banking report that DigitalMR launched in April this year, however many of these posts are negative and could in fact harm Deutsche Bank in the real world; in terms of valuation and bottom line impact that is.

In social listening & analytics, the starting date and the time period for which data is to be analysed is not restricted to the date one decides to carry out the project, like it would be in traditional market research (e.g. customer surveys), as we have the ability to harvest and analyse posts from the past. In this first report DigitalMR analysed English posts about 11 banks, found on Twitter, YouTube, News, Forums, Blogs, and Reviews, during the 12 months of May 2018 – April 2019 inclusive.

As you can see below, Deutsche Bank with its 1.9 million posts across all sources, commands an impressive 48% share of voice among the banks.

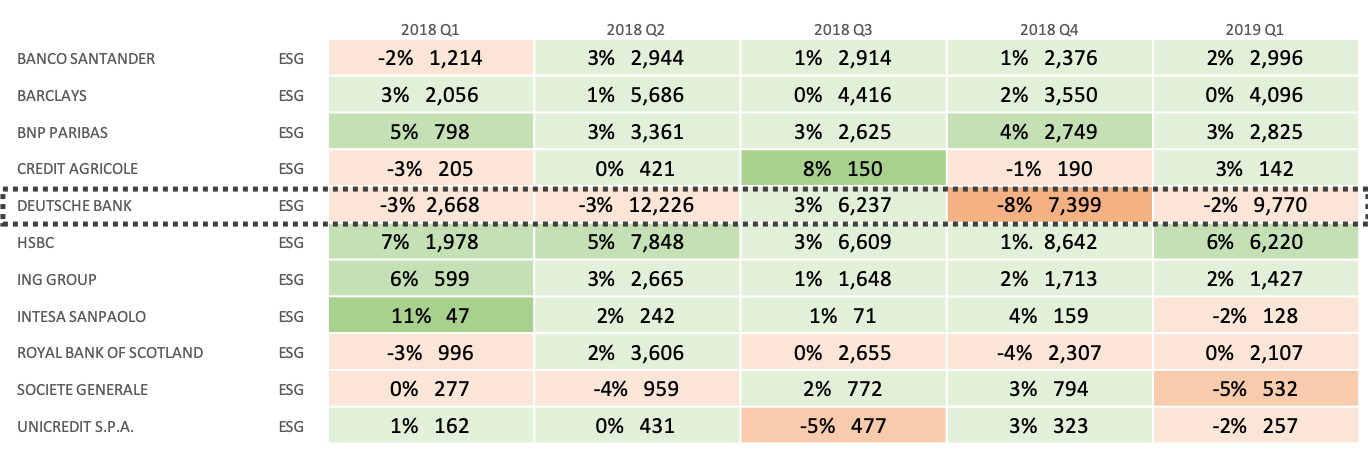

Despite having the largest number of posts, Deutsche Bank is underperforming in ESG, which stands for Environmental, Social, and Governance. Interestingly, news on governance is the driving force behind negative posts about the bank.

In the table below you can see the Net Sentiment Score™ (NSS™) for ESG by bank, where a negative NSS™ is observed in 4 out of 5 quarters for Deutsche Bank. NSS™ is a composite metric in the social intelligence world, that mirrors the well known Net Promoter Score (NPS) from surveys.

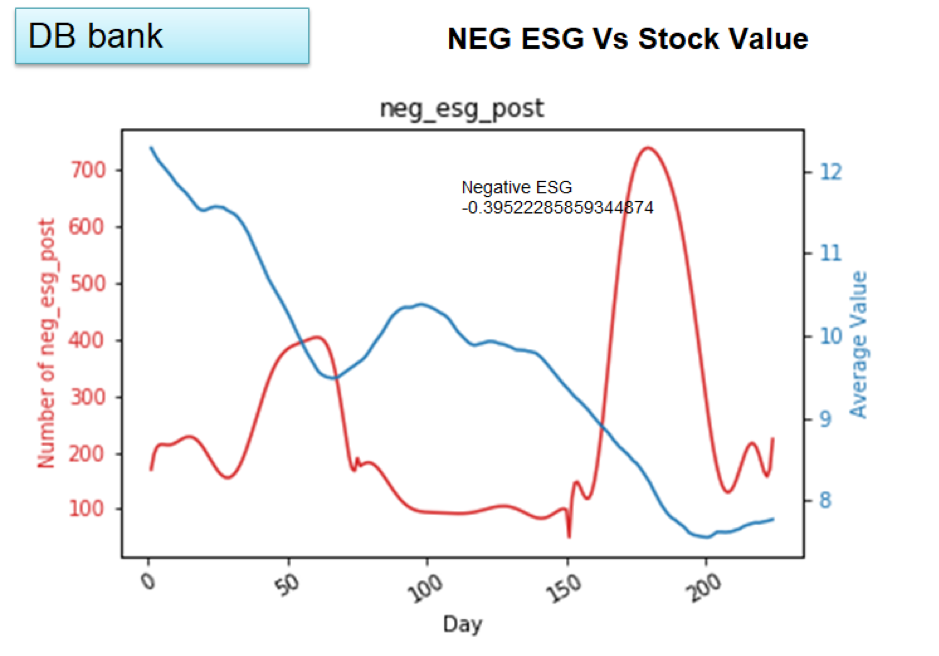

Unsurprisingly, the number of posts about ESG with negative sentiment has a high negative correlation with Deutsche Bank’s valuation based on its daily stock price. The negative correlation is even visible to the bare eye in the chart below: when the red line for negative sentiment about ESG goes up, the blue line for the bank’s value goes down.

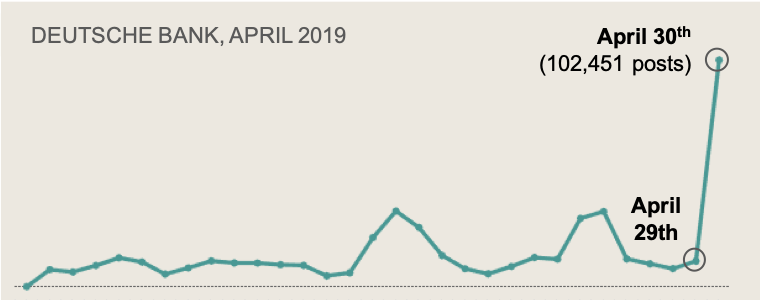

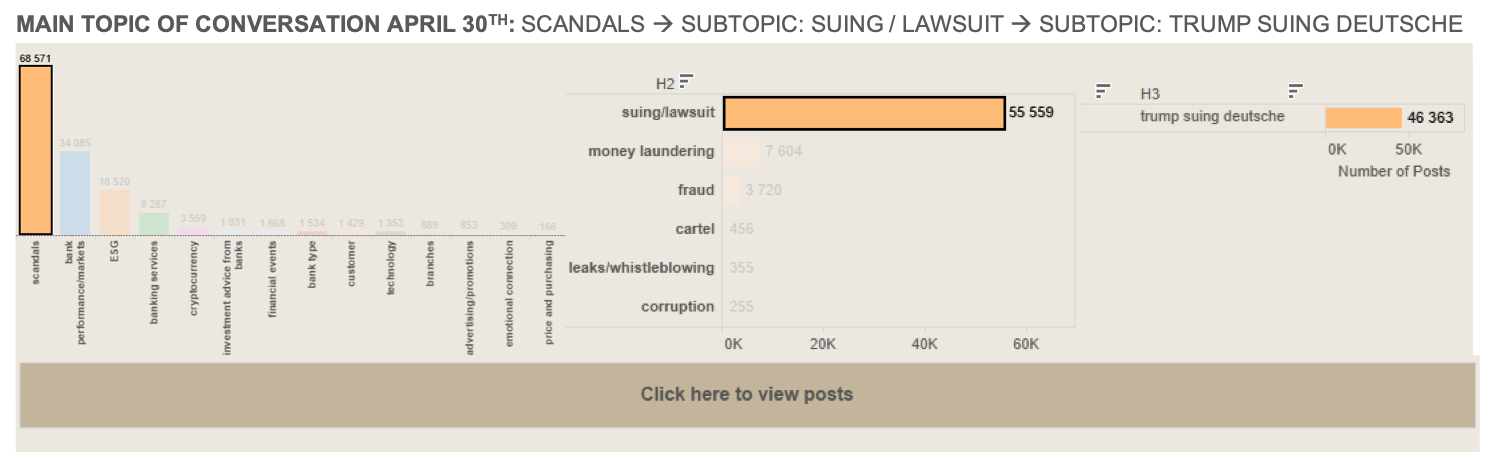

It never ceases to amaze me how news, in particular negative news, about well known brands and people pick up and in a matter of a few hours become viral. In the case of Deutsche Bank, a jump of 5-10x can be seen literally from one day to the next (April 29/30), the main reason being that the Trump family was suing the bank.

Ideally Deutsche Bank and every other corporation should be able to track buzz around their corporate brand, all their product brands and senior people, so they can react immediately when a PR crisis is about to happen. Containment would be the key intent in cases like this, but the pre-condition is that the bank has access to a social intelligence solution such as listening247. Using any social media monitoring tool is not good enough, buyers need to be informed on what is needed for accurate analysis and avoiding GIGO (garbage in…), and they need to have proof of the sentiment, brand, and topic annotation accuracy of the tool or solution before subscribing. A minimum of 75% accuracy is achievable in all three cases, in all languages.

Further to managing crises there are of course numerous other use cases of social intelligence for various bank departments; a couple of obvious ones are:

- operational issues can be brought to the attention of senior management in order to be addressed

- early warnings can be provided for any underlying problems before they get out of hand

Another useful feature for a social intelligence solution is to be able to look at topics (e.g. scandals) of conversations within brands; and not only that but to also be able to drill down into multiple levels of subtopics, as shown in the image below.

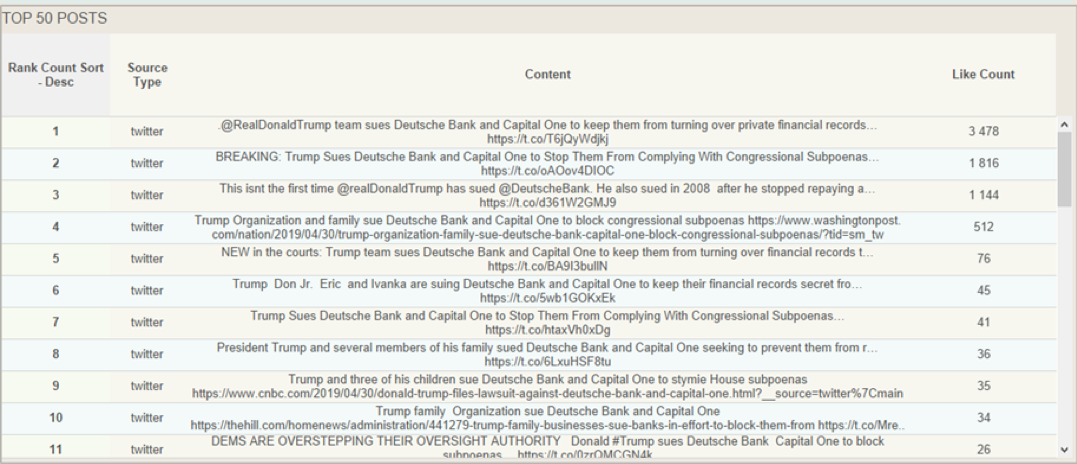

The real magic in a solution like listening247 actually happens when you “click here to view posts” once you have made all your selections on the drill down dashboard; this is where you actually get to see what people really said about ‘Trump suing Deutsche’ (examples in the screenshot below). What makes it even better is that when you click on any one of those posts you are taken to the original post on the platform where it was posted.

Stay tuned for more stories with findings from the social intelligence report for banks brought to you by listening247 and DigitalMR. In the next story we will analyse how banks can predict their future business performance expressed in their daily stock closing price using accurate social intelligence. In the meantime please do connect with me on Twitter @DigitalMR_CEO or email me at mmichael@digital-mr.com to ask questions or offer a view on this article.

Share this article: