Have Banks discovered the value of Social Intelligence yet?

This is a short story about social intelligence (SI) and banks…

listening247 – DigitalMR’s social intelligence solution – has a unique selling proposition: its high multilingual accuracy for brand, sentiment and topics annotation. Unfortunately, this unique selling proposition is also one of listening247’s biggest obstacles to scale. This trade-off between accuracy and scalability was of course not a surprise, it was a conscious decision made by a team of people who (as market researchers) have a tremendous respect for data accuracy; sometimes to their detriment. Thankfully, one day not too long ago, they realised that scalability does not have to be a trade-off for high accuracy.

With listening247, a standard 3-week time period is usually needed to create new custom machine learning models each time new product categories and languages are to be analysed; new being the operative word. This is exactly how DigitalMR has been able to reach higher brand, sentiment and topics accuracy than competitors on the market. What the team of researchers realised was that once the custom machine learning setup (specific to a product category and language) exists, they could be on the same footing as every social media monitoring tool on scalability, but with a much higher accuracy!

To put the theory to the test, one industry vertical was selected, and the necessary setup was created. That industry vertical was Banking.

Why Banking?

The decision was by no means easy, there were many variables to consider - perhaps too many; a strawman proposal was created and shared with the entire company and its advisors, and after a few weeks of back and forth, the banking sector was chosen.

It would have perhaps been easier to choose a straight forward FMCG product category, or maybe retail, healthcare, automotive, or telecoms, but there are many good reasons why this vertical deserves focus. Those involved felt it’s time for banks to be enlightened as to the possibilities available to them in understanding their customers and competitors alike.

Here are some factors that influenced the decision-making process in favour of banking:

- Banking is a particularly interesting sector as it offers both B2C and B2B services

- DigitalMR had produced SI banking reports in the past, in 2011 for the UK and in 2012 for the USA, and therefore already had a good understanding of the category and what would be involved in the semantic analysis (topics) setup in English.

- More recently DigitalMR had also produced a report on banks in Hong Kong, analysing social data in traditional Chinese.

- Within this vertical there are multiple sub-categories which exist as independent business units with P&L reports and their own budget to invest in business intelligence such as retail, corporate, wealth management, credit cards, insurance etc.

- A relevant opportunity with an academic institution was in sight, making the timing right. This was a R&D project about understanding how ESG – G for governance in particular – has an impact on a bank’s business performance. In case you are not familiar with the acronym ESG (a popular topic of conversation within the financial services sector) E stands for environmental and S stands for social.

- The legacy banks in this sector lack innovation and are increasingly being disrupted by challenger banks, blockchains and AI. If banks don’t already feel the urgency to make some drastic changes in the way they operate, they really should, and someone needs to help them get on the right path.

The scope of the 1st report on Social Intelligence for Banks in 2019

The process started by selecting 11 major and mostly multinational banks with the help of a high-profile industry advisor, to be used as keywords for data harvesting.

Language: English

Geography: Global

Time Period: past 12 months

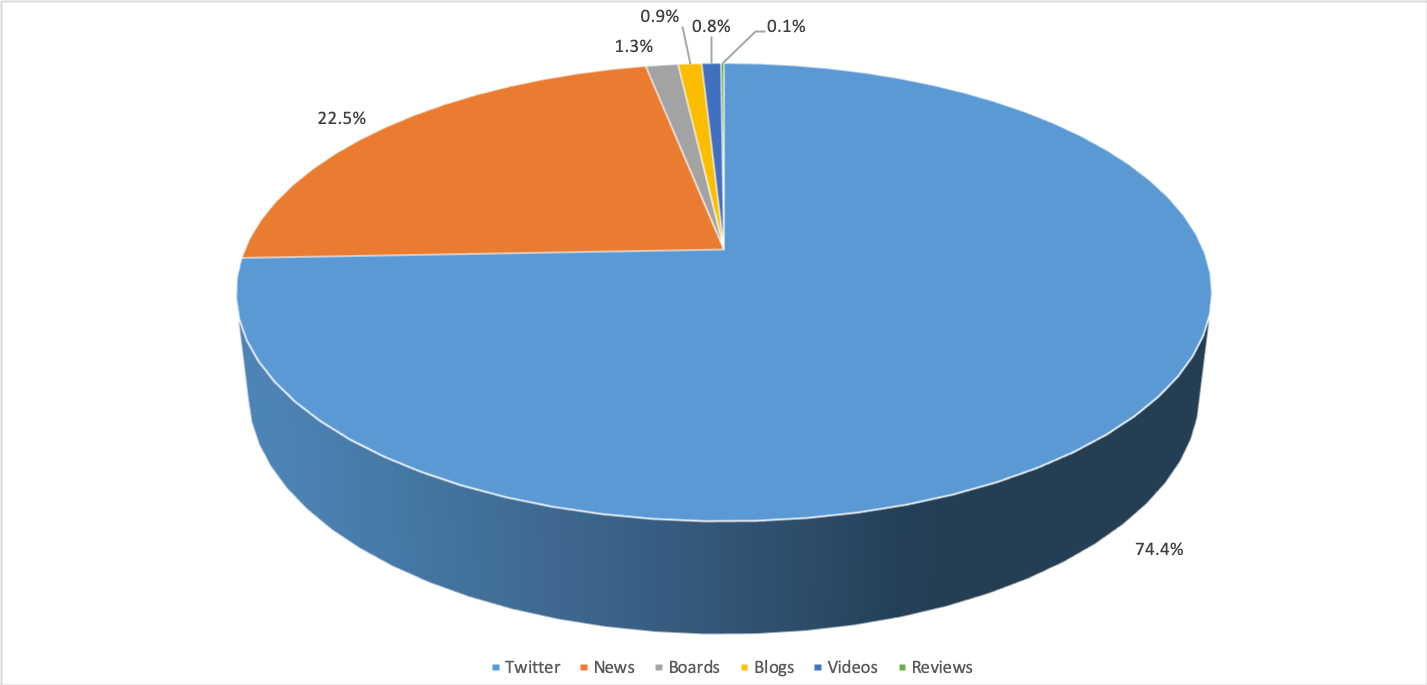

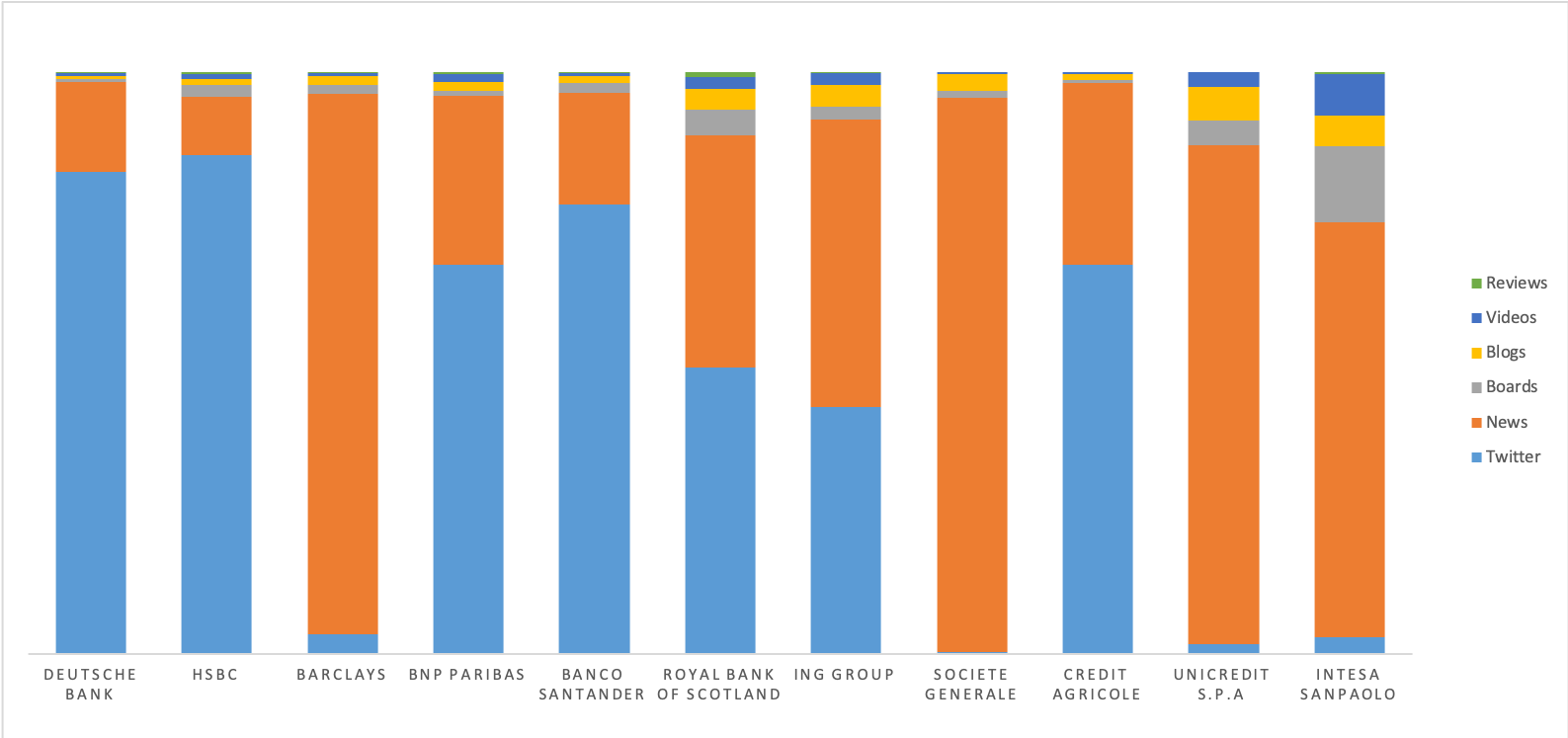

Data sources: Twitter, blogs, boards / forums, news, reviews, videos

Machine learning annotations: sentiment, topics, brands, and noise (irrelevant posts picked up due to homonyms)

Deliverables: CSV with annotated data, Excel tables, drill-down and query dash boards, PowerPoint presentation

As part of the R&D project with the academic institution, the daily valuations of each of the 11 banks were also retrieved from Yahoo Finance and Google Finance and taken into account.

Volume of online posts justifies tracking bank performance online

A total of 4.5 million English posts was harvested for the 11 banks globally. As you can see in the chart below, Twitter is by far the largest source of posts, followed by News – the only non-consumer source with mostly editorials published by journalists (or even the banks themselves).

Looking at each bank individually, Twitter remains the largest source of posts for Deutsche Bank, HSBC, BNP Paribas, Santander and Credit Agricole, indicating that consumers do actually talk about their banks online, especially when they have complaints. On the other hand, the largest source of posts for banks such as Barclays, Société Générale, UniCredit and Intesa Sanpaolo is News, implying that either the customers of these banks have no complaints to share, or that they simply do not focus on engaging with them on social media.

The first presentation & report highlights

These findings were originally presented to a group of board directors of banks from various countries, who were taking part in the International Directors Banking Programme (IDBP) at INSEAD. Below are some of the report highlights.

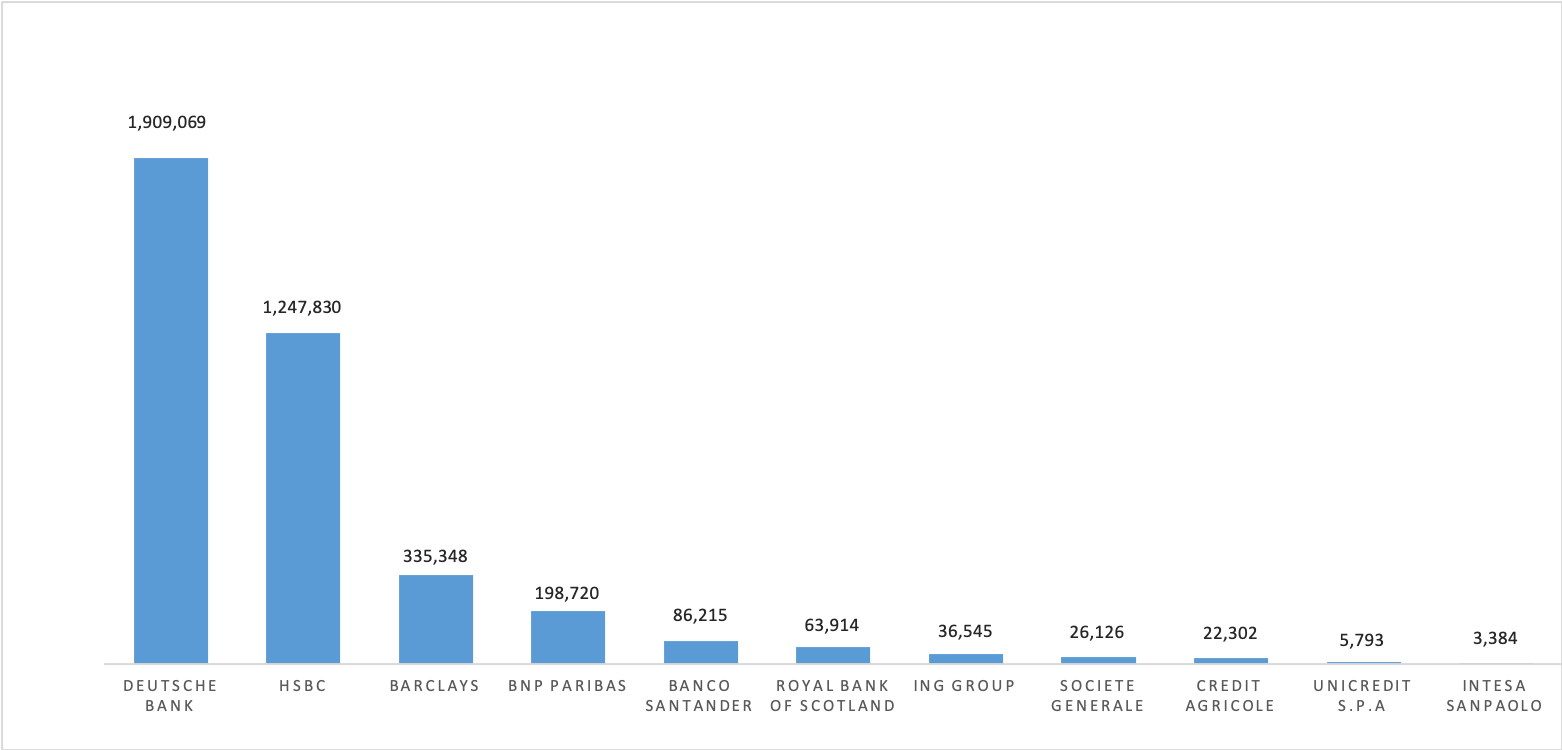

- Deutsche Bank ranks first in buzz

Deutsche Bank ranks first in terms of buzz (i.e. total volume of posts) with over 1.9 million posts coming from all sources. This represents 48% share of voice for Deutsche Bank, with HSBC and Barclays in 2nd and 3rd place respectively.

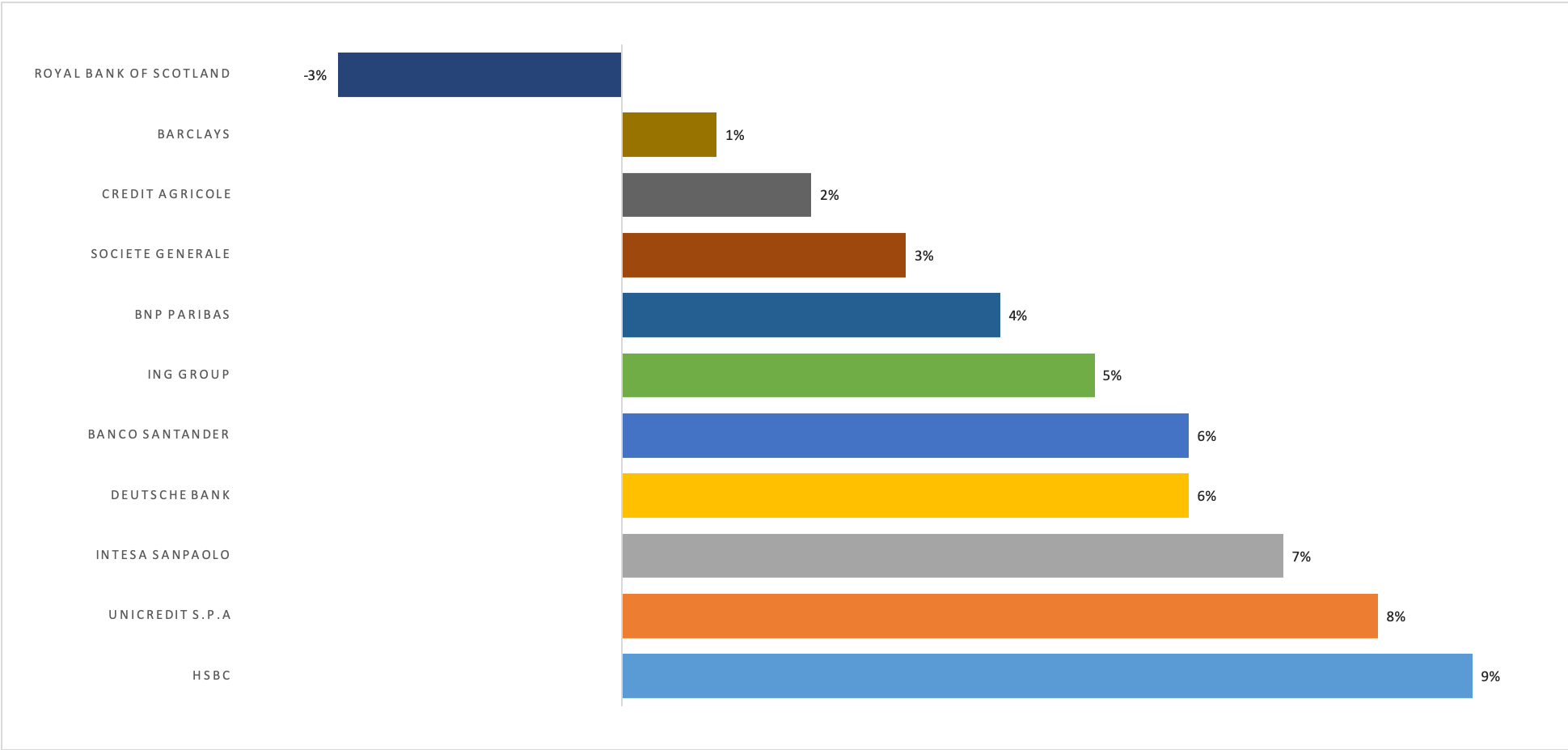

- RBS has the lowest NSS™

The Net Sentiment Score™ (NSS™) is a trademarked DigitalMR metric that combines all positive, negative, and neutral posts offering a composite metric that can be seen as the social equivalent of what NPS is to surveys. The Royal Bank of Scotland has the lowest NSS™ out of all 11 banks with a score of -3%, while HSBC leads the pack with a score of +9%. Interestingly enough, compared to other verticals or product categories a top NSS™ score of 9% is quite low.

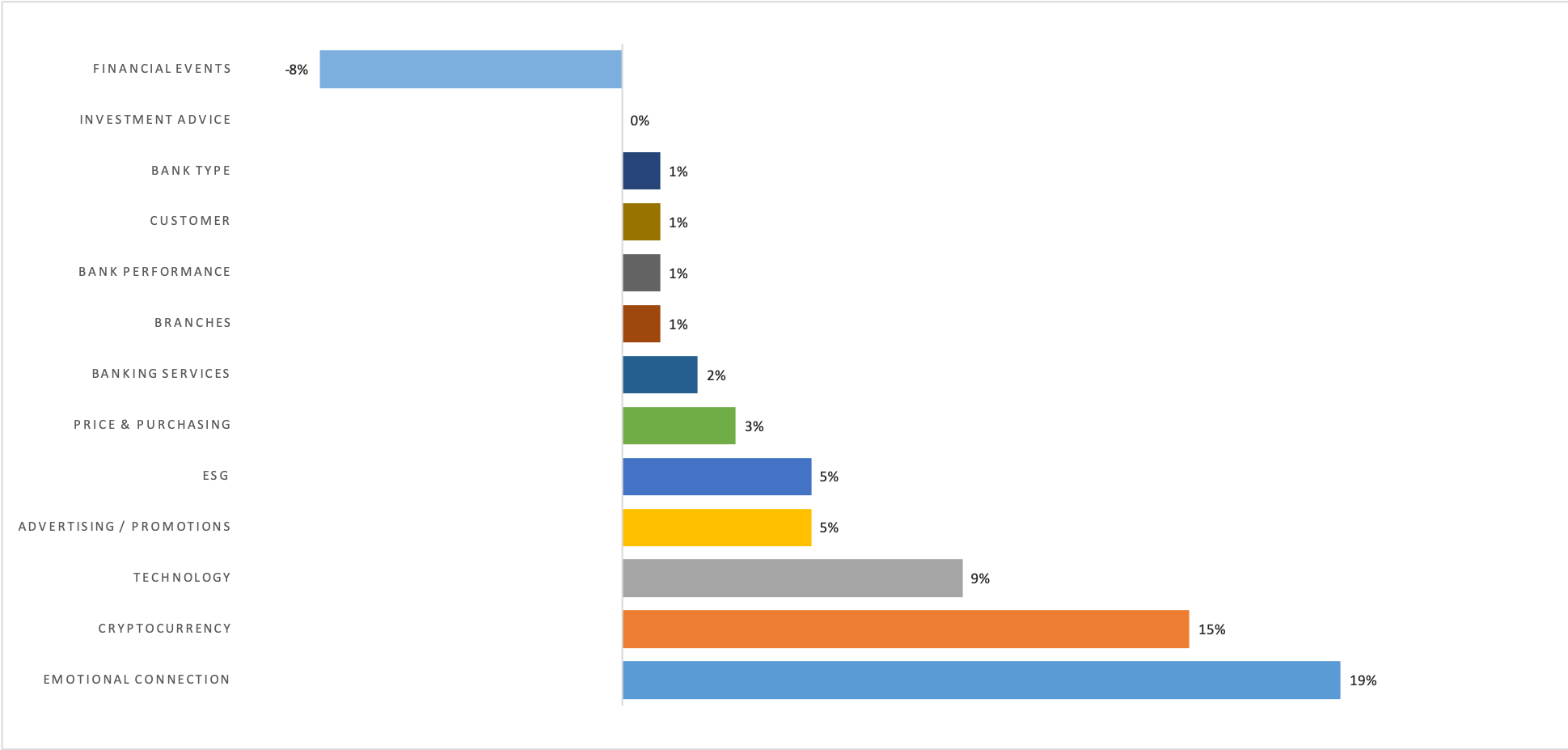

- Emotional Connection and ESG are hot topics

When it comes to topics of online conversations and consumer sentiment in regards to those, financial events scored a NSS™ of -8%. ESG scored a +5%, while the best performing topic of emotional connection scored a +19%. Once again, ESG seems to be a very hot topic around banks and other corporates.

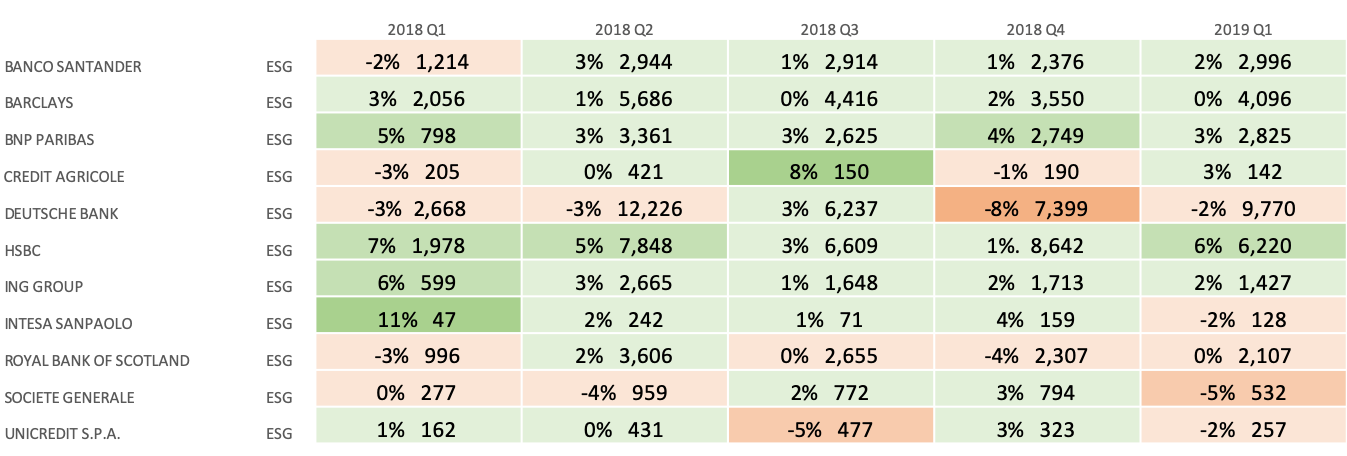

- Deutsche Bank and RBS negative NSS™ for ESG

This report can be quite granular in terms of topics and time periods. The below table drills down into the topic of ESG, showing the NSS™ for each bank (in relation to ESG) by quarter. Colour coding makes it very easy to pinpoint problem areas. In this case, Deutsche Bank and RBS are the two banks with the most quarters showing a negative NSS™.

During the event presentation it seemed as if the board level executives present had never seen anything similar in the past, taking in the results with a dose of scepticism, and of course asking several questions. Some wanted to drill-down and understand more about the findings from this data; those coming from the banks included in the project more so than others. The question is: will they be able to persuade the management of their banks to integrate social intelligence into all the other data streams they currently use?

What makes this report credible is that we know its sentiment and topic accuracy is over 75%. This is not just a claim, a human can verify it by extracting a random sample of 100 posts, reading through them, and checking their agreement with the machine learning algorithm annotations (brand, sentiment, and topics). There should be agreement with any of the above annotations for at least 75 posts.

The next story

This is only the first of a series of short stories on this banking report. By the time the next one is published, our machine learning models will have improved themselves to reach accuracies over 80%.

If you are wondering what other ways there are to create value for a bank from a social intelligence report as such, stay tuned! In the next article you can expect to find out how news about governance impact the valuation of one of the 11 banks in this report. For anyone too impatient to wait another couple of weeks, feel free to reach out to me on Twitter @DigitalMR_CEO or email me at mmichael@digital-mr.com. Talk soon!

Share this article: